Akuapem Rural Bank Reports Remarkable Improvement in Operational Performance

- makes significant impact in Credit with Education

- shareholders get dividend payment of GH₵0086 per share

- Admin

- 18th July 2023

Akuapem Rural Bank PLC, headquartered at Mamfe in the Akuapem North District of the Eastern Region, has demonstrated strong resilience and posted remarkable financial growth across all key indicators.

For the 2024 financial year under review, the Bank disbursed loans and advances totaling approximately GH₵112.4 million, of which a little over GH₵60.3 million—representing 49.93%—went to the Credit with Education (CwE) Scheme under the Bank’s Microfinance operations.

The CwE program, designed to support women, currently covers 359 groups with 5,267 clients. The Bank’s overall Loans and Advances Portfolio grew by 29.01% in 2024 compared to 53.54% in 2023, reaching a little over GH₵54.9 million in 2024 from GH₵42.5 million in 2023. Of this, CwE loans accounted for 24.5% (GH₵13,874,317) of the total loan portfolio, recording an exceptionally low Non-Performing Loan (NPL) ratio of 0.13%.

The Board of Directors has proposed a cash dividend of GH₵0.0086 per share, amounting to GH₵1,347,857 for the 2024 financial year. This represents 35% of profit after tax and has received approval from the Bank of Ghana. The Board expressed optimism that continued strong performance will sustain dividend payments in the coming years.

The Bank’s Net Interest Income rose from approximately GH₵24.4 million in 2023 to over GH₵35.2 million in 2024, reflecting growth of 44.67%. This increase was driven by expansion in the loan and investment portfolios as well as higher interest rates on treasury bills and fixed deposits.

Operating expenses also increased, rising from about GH₵22.3 million in 2023 to GH₵31.7 million in 2024, a 42.37% jump. The main contributors to this increase were staff costs and general administrative expenses. Despite these rising costs, the Bank recorded a post-tax profit of roughly GH₵3.85 million in 2024, a significant 186.1% increase over the GH₵1.34 million posted in 2023.

These achievements and more were announced by the Chairman of the Board of Directors, Dr. Ernest Obuobisa-Darko, during the Bank’s 43rd Annual General Meeting of shareholders held last Saturday at the Assembly Hall of Methodist Girls’ Senior High School in Mamfe, Eastern Region.

Operational Environment

According to him, Ghana’s economy showed stronger-than-expected performance in the first three quarters of 2024. Data from the Ghana Statistical Service indicated that real GDP grew at an annual rate of 6.3 percent during this period, compared to 2.6 percent in the same period of 2023. Non-oil GDP also recorded growth of 6.2 percent, up from 3.3 percent a year earlier.

On the international commodities market, export prices presented a mixed trend in 2024. Cocoa prices surged significantly, reaching US$10,869.10 per tonne in December 2024, up from US$4,235.60 per tonne in December 2023. This sharp rise was driven by reduced supply resulting from adverse weather conditions affecting major producers, including Côte d’Ivoire. Gold prices also climbed by 29.4 percent, rising from US$2,035.40 per fine ounce in December 2023 to US$2,641.50 per fine ounce in December 2024.

In contrast, crude oil prices declined, falling by 5.3 percent year-on-year to an average of US$73.20 per barrel in December 2024. The decline was influenced by concerns about supply risks and the expectation of increased output in 2025.

Private sector credit growth continued to rebound, gradually approaching pre-2022 macroeconomic crisis levels. Nominal credit growth rose to 26.3 percent in December 2024, up from 10.7 percent in the same period of 2023. In real terms, credit to the private sector expanded by 2.0 percent, reversing the 10.2 percent contraction recorded a year earlier.

The banking sector remained profitable, well-capitalized, and liquid in 2024. Total assets of the sector grew by 33.8 percent during the year. The Capital Adequacy Ratio (CAR) with regulatory reliefs inched up slightly to 14.0 percent in December 2024 from 13.9 percent in December 2023. Without reliefs, CAR stood at 11.3 percent, a notable improvement from 8.3 percent in December 2023. Although banking sector profits rose in 2024 compared to 2023, the growth rate slowed, leading to moderated profitability indicators.

Looking ahead, elevated credit risk remains a key challenge for the banking industry. The sector’s Non-Performing Loans (NPL) ratio increased to 21.8 percent in December 2024, up from 20.6 percent in December 2023.

Operational Performance

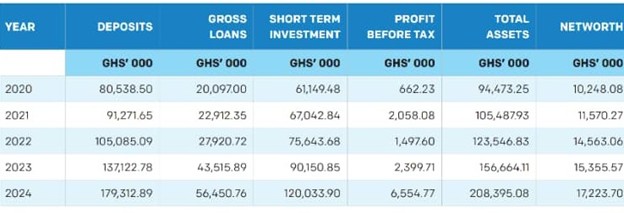

Despite the challenging macroeconomic conditions and high inflation during the year under review, the Bank delivered another impressive operational performance across all key financial indicators, as shown in the table.